Overview

Each resource type in Flex can have sales tax applied to it. For example, you can have sales tax apply to rental and retail items, but not to labor and travel.

You also have the ability to apply a different sales tax rate for each of your business locations if your Flex subscription includes more than one location. This is especially applicable to customers who have multiple locations in different states.

Adjusting the percentage of a sales tax rule that is currently in use can cause unexpected calculation changes. Alternatively, we recommend creating a new sales tax rule.

Setting up a Sales Tax Rule

- In the Main Menu, go to System Settings and select Sales Tax Rules.

- Double-click the Sales Tax Rule. OR select the Options Menu of the sales tax rule and click Open.

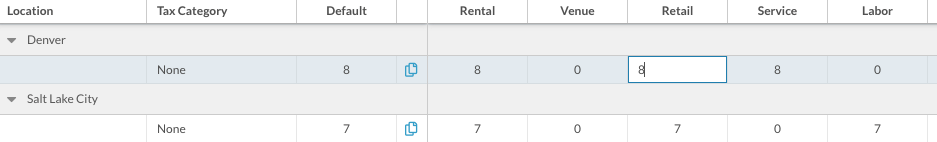

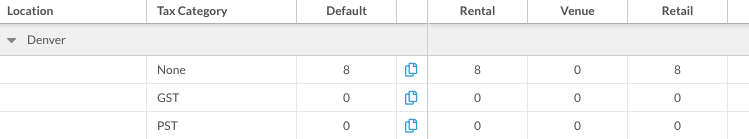

- Enter a percentage value in each category that you want to charges sales tax (example: 5% = 5).

Each value will automatically save. There is no save button on this page.

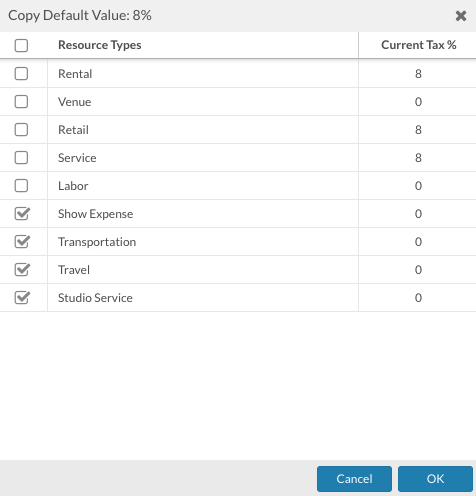

The "Default" column is used to apply sales tax to line items that don't technically belong to a specific resource type, like a Misc line item. In addition, you can also use the "Default" value to copy to other resource types for that location. To do so, click the Copy icon located to the right of the "Default" column and select the Resource Types that you want this value to paste to.

Adding a New Sales Tax Rule

- In the Main Menu, go to System Settings and select Sales Tax Rules.

- Click Add New Sales Tax Rule icon in the footer.

- Give the new rule a name and a code (For example, Name: New Tax Rules. Code: NEWRULE).

- Click OK.

After creating a new sales tax rule, the tab will refresh and you will see the new Sales Tax Rule. Refer to the previous section, Setting up a Sales Tax Rule, to learn how to set the sales tax values for your new tax rule.

Enabling and Setting Default Sales Tax Rules on Project Elements

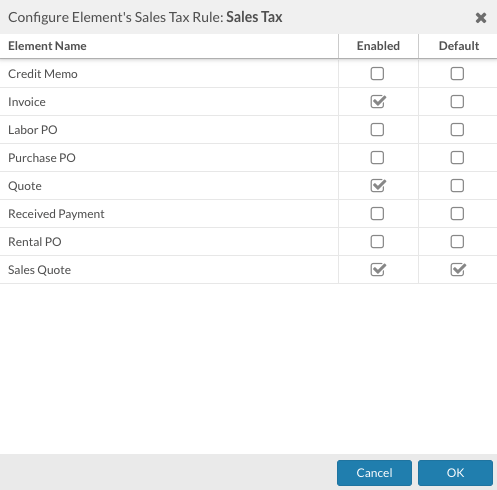

Each sales tax rule that you create will need to be enabled on the financial project elements (Quotes, Invoices, etc.) that you want to use them on.

- In the Main Menu, go to System Settings and select Sales Tax Rules.

- Click the Options Menu of the sales tax rule that you want to enable.

- Click Configure Elements.

- Select the elements that you want this rule enabled for use on and/or that you want the element to default to.

- Click OK.

if you set a default sales tax rule for your Quote element (or other financial element), that sales tax rule will automatically apply to any new Quote you create. If a contact has their own default sales tax rule, then the contact’s default will override the Quote element default.

Setting a Default Sales Tax Rule for a Contact

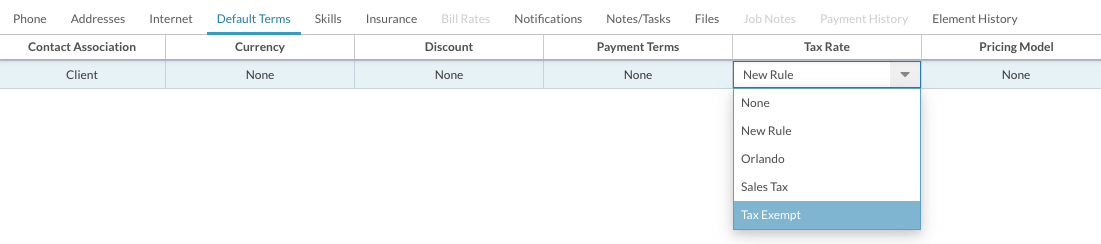

- Open the contact entry that you want to set a default sales tax rule for.

- Click the Default Terms tab.

- Choose a default sales tax rule from the Tax Rate drop-down menu.

All changes made in the Default Terms tab are automatically saved.

Now whenever you use that contact as the client on a Quote, the default sales tax rule will be used, overriding any global default tax rule set up on the Quote element. Also note, this can not be set for contacts that are associated with a company and "Inherit Default Terms" is set to yes.

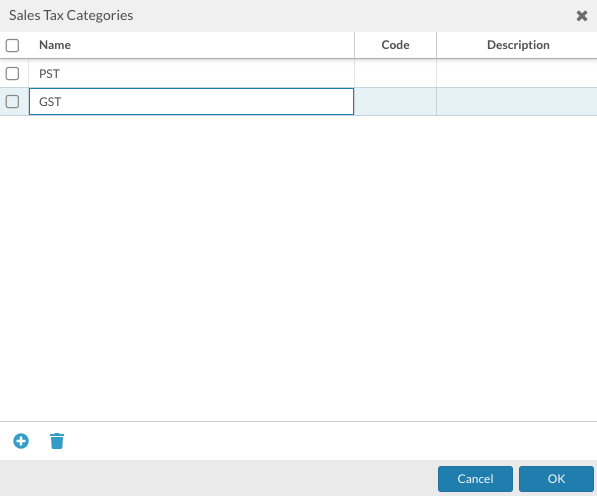

Sales Tax Categories

You can enable multiple sales tax categories, then have each category show on financial documents. Sales tax categories are especially useful for companies that need to show a breakdown of multiple different taxes that are being charged. For example, in Canada, you often have to break down taxes by PST and GST.

How to create new sales tax categories:

- In the Main Menu, go to System Settings and select Sales Tax Rules.

- Click the Configure Sales Tax Categories icon in the footer.

- Within the Sales Tax Categories popup, click the Add New Sales Tax Category icon.

- Enter the Name (Code and Description are optional.)

- Click OK

How to enable sales tax categories on a sales tax rule:

- In the Main Menu, go to System Settings and select Sales Tax Rules.

- Double-click the Sales Tax Rule. OR select the Options Menu of the sales tax rule and click Open.

- Choose a sales tax category(s) from the Enable Tax Categories drop-down menu in the footer.

The enabled categories will now be visible in the Tax Category column and you can enter percentage values in each category.

Deleting a Sales Tax Rule

- In the Main Menu, go to System Settings and select Sales Tax Rules

- Select the checkbox(s) of the sales tax rules you want to delete and click the Delete Selected Sales Tax Rule(s) icon in the footer. OR select the Options Menu of the sales tax rule and click Delete.